Futures Forum: A solution to our housing problems: kill the property porn shows

But it's not just confined to the UK:

Is a high home ownership rate a sign of a

successful country?

I

saw an El Pais spread on this, which I cannot find

on-line. Here are the European countries with the highest owner occupancy

rates:

1.

Romania, 97.5%

2.

Lithuania, 93.1%

3.

Croatia, 90.1%

4.

Slovakia, 90.0%

How

about the lowest rates?

1.

Switzerland, 44.3%

2.

Germany, 53.2%

3.

Austria, 57.4%

Get

the picture?

The

Link Between High Levels of Homeownership and Unemployment

Communities

with lots of homeowners may restrict labor mobility, generate longer

commutes, and lower rates of new business formation.

Homeownership

is a vaunted cornerstone of the American Dream. It's long been viewed as

providing a path to financial security and the good life. And it's often posed

as a barometer of the health of the economy writ large. it's been center stage,

after all, in the ongoing conversation about the economic crisis and recovery.

The American government has provided substantial incentives to spur

homeownership for decades.

But,

in recent years, a growing chorus of economists have argued that America may

have gone overboard in its pursuit of homeownership. They suggest that high

rates of homeownership distort the economy, tying people to places and

restricting the ability of workers to move to jobs.

A

new working paper provides powerful evidence of that higher rates of

homeownership may in fact be connected to higher rates of unemployment. The

study, "Does

High Home-Ownership Impair the Labor Market?" [PDF], by

economists Andrew Oswald, whose earlier research argued that high rates of

homeownership undercut labor mobility, and David Blanchflower of

Dartmouth University, employes a large-scale data set covering the past 25

years (1985-2011) and more than two million American households to examine the

connections between homeownership and unemployment,

labor mobility, commuting times, and

new business formations.

The country where 70% of millennials are homeowners

GETTY/KEVIN FRAYER

GETTY/KEVIN FRAYER

If you're aged 19-36 and don't own your home, you're probably not reading this in China.

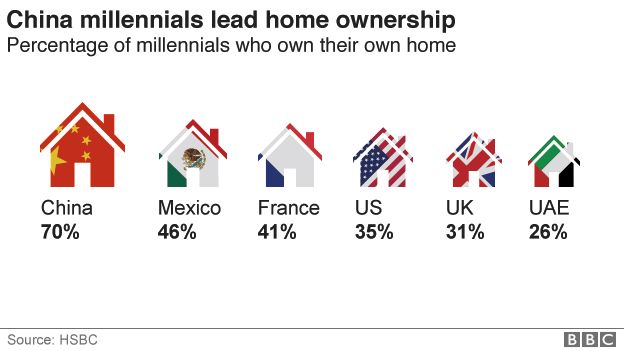

While young people around the world are struggling to get on the property ladder, an HSBC study found that 70% of Chinese millennials have achieved the milestone.

A sizeable 91% also plan to buy a house in the next five years, according to the survey.

The mortgage lender spoke to around 9,000 people based in nine countries.

While China came out top of the pack, Mexico was next with 46% of millennials owning property, followed by France with 41%.

In Malaysia, the US, and Canada, just over a third of the age group have bought a house or flat, while in the UK it's 31%.

Worst off in the bricks and mortar stakes are Australia and the UAE, where 28% and 26% of millennials own their own homes respectively.

HSBC noted that 83% of those surveyed who were not homeowners had plans to buy within the next five years. Mexicans and Malaysians were most likely to harbour the ambition, with 94% saying so.

- How to own a home by the age of 25

- Why millions of Chinese men are staying single

- Give up avocado toast and buy a house?

Although its ownership figures were on the higher side, France had the lowest number of would-be buyers, at 69%.

This may be because historically, the country has not placed the same value on home ownership as its neighbour across the Channel. Renting is completely socially acceptable - especially in costly cities like Paris and Lyon.

GETTY IMAGES

GETTY IMAGES

For many people aged 19-36, houses remain unaffordable because they have not saved enough for a deposit. Property prices in eight of the nine countries studied increased in 2016.

The rise in house prices relative to salary growth also leads to issues.

Almost two-thirds of respondents said they would need higher earnings to buy a home, but seven of the nine countries are facing real salary growth of less than 2% in 2017.

In the UK, for example, house prices rose by 7.5% in 2016, according to the International Monetary Fund, while wages are expected to rise by 1.9% this year.

How do Chinese millennials buy their homes?

According to Forbes, China has seven of the world's top 10 most expensive cities for residential property. In Shanghai, there were even reports of couples getting fake divorces to exploit a home-owning loophole.

HSBC said 85% of those surveyed in China were in urban areas, with 14% in the suburbs and 1% in rural areas.

So how have so many millennials managed to buy their homes?

For sons in particular, it's down to the Bank of Mum and Dad - and underpinned by the marriage market.

Thanks to the One Child Policy, there will be 30 million more men than women looking for a partner in China by 2020.

AFP

AFP

Chinese parents know their sons' chances of marrying well are materially increased if they own a home.

Dr Jieyu Liu, deputy director of the SOAS China Institute, told the BBC: "It is the custom that husbands will provide a home.

"As young people's wages are too low, the husband's family is expected to take on the responsibility to purchase the property in their son's name, or pay the deposit.

"Many love stories fail to turn to marriage if the men fail to provide a marital house."

And then there's the fact that elderly Chinese often move in with their children in their twilight years.

As a result, many see buying a property in their son or daughter's name as an investment in the family's future.

Chinese parents are also good savers, with many squirreling away around 30% of their income. Other relatives may be called on to help too, as first home deposits are often at least 30%.

And if the housing market's in bad shape? No problem. They're prepared to buy years in advance to get a good deal.

Reporting by Rebecca Seales

The country where 70% of millennials are homeowners - BBC News

.

.

.

No comments:

Post a Comment