Futures Forum: Plasticphobia @ Radio 4's Costing the Earth

Especially our councils:

Futures Forum: Plastic waste > County Council's workshop ‘Making plastic pollution a thing of the past’ > but "the fact that plastic recycling is dubious and not the answer... got very heated"

Futures Forum: Councils face mounting costs of dealing with plastic waste: "manufacturers should take up more of the responsibility for dealing with these unrecyclable materials"

Because the international system we have relied on is breaking down:

Futures Forum: We should be following the "proximity principle" and dealing with our own recycling waste at home

Futures Forum: UK plastic pollution ending up in Poland, rather than China

Futures Forum: Waste crime is the “new narcotics” >>> UK plastic pollution ending up in Poland once again - and being sent back

Futures Forum: The plastics recycling industry is facing an investigation into suspected widespread abuse and fraud within the export system

Futures Forum: "The golden shores of Bali are being lost under a mountain of garbage"

An excellent piece from the FT looks at what's happening:

Why the world’s recycling system stopped working

China’s refusal to become the west’s dumping ground is forcing the world to face up to a waste crisis

Leslie Hook and John Reed

OCTOBER 25, 2018

As Robert Reed examines a mountain of trash piled three storeys high, a thin white plastic bag catches his eye. He fishes it out and holds it up. “That is a problem plastic,” he says gravely. “These get stuck in the machines, and there is no market for them.” He gives it a little wave and lets it float back down on to the heap.

We are standing inside the largest recycling facility in San Francisco, which takes in household waste, sorts it and produces tidy bales of material at the end. Broken glass crunches underfoot as Reed, a 20-year veteran of the industry, explains with pride that this plant, owned by local waste-management company Recology, is the most advanced of its kind on the West Coast, using lasers, magnets and air jets to process 750 tonnes each day.

“See all this paper?” he says, approaching the mound of waste and gesturing to an Amazon box. “We’ve started to get a lot more of this because of all the online shopping.” Some of the materials sorted here are valuable, such as aluminium cans, steel and cardboard. But others are worthless, like coffee-cup lids or black plastic food trays.

As we reach the end of the sortation centre, bale after bale of sorted plastic looms up. From here it will be sold to processors, often in Asia. China was by far the biggest customer last year.

More than 270 million tonnes of waste are recycled across the world each year, according to the World Bank — equivalent to the weight of 740 Empire State buildings.

Bantar Gebang landfill dump, near Jakarta © Kadir van Lohuizen/NOOR

Since the introduction of kerbside household recycling in the 1980s, recycling has been promoted as the environmental answer to humanity’s growing amounts of rubbish. It has also developed into a $200bn industry globally, according to the Bureau of International Recycling.

‘Wasteland’: about the photographs

The images accompanying this feature are from a series by Kadir van Lohuizen, who has been documenting how six megacities — Jakarta, Tokyo, Lagos, New York, São Paulo and Amsterdam — manage or mismanage their waste since 2016

Companies and brokers have lined up to buy this waste and turn it into new products: a kind of straw-into-gold process that can at times be remarkably profitable. At the centre of the system is a brisk global trade in scrap materials shipped around the world. But this year, all that changed.

On December 31 2017, China, previously the centre of the global recycling trade, abruptly shut its doors to imports of recycled material, citing the fact that large amounts of the waste were “dirty” or “hazardous” and thus a threat to the environment. The prices of plastic scrap collapsed, as did the price of low-grade paper. Suddenly, the lucrative trade that had sprung up shipping recyclables around the world was in crisis.

Since the introduction of kerbside household recycling in the 1980s, recycling has been promoted as the environmental answer to humanity’s growing amounts of rubbish. It has also developed into a $200bn industry globally, according to the Bureau of International Recycling.

‘Wasteland’: about the photographs

The images accompanying this feature are from a series by Kadir van Lohuizen, who has been documenting how six megacities — Jakarta, Tokyo, Lagos, New York, São Paulo and Amsterdam — manage or mismanage their waste since 2016

Companies and brokers have lined up to buy this waste and turn it into new products: a kind of straw-into-gold process that can at times be remarkably profitable. At the centre of the system is a brisk global trade in scrap materials shipped around the world. But this year, all that changed.

On December 31 2017, China, previously the centre of the global recycling trade, abruptly shut its doors to imports of recycled material, citing the fact that large amounts of the waste were “dirty” or “hazardous” and thus a threat to the environment. The prices of plastic scrap collapsed, as did the price of low-grade paper. Suddenly, the lucrative trade that had sprung up shipping recyclables around the world was in crisis.

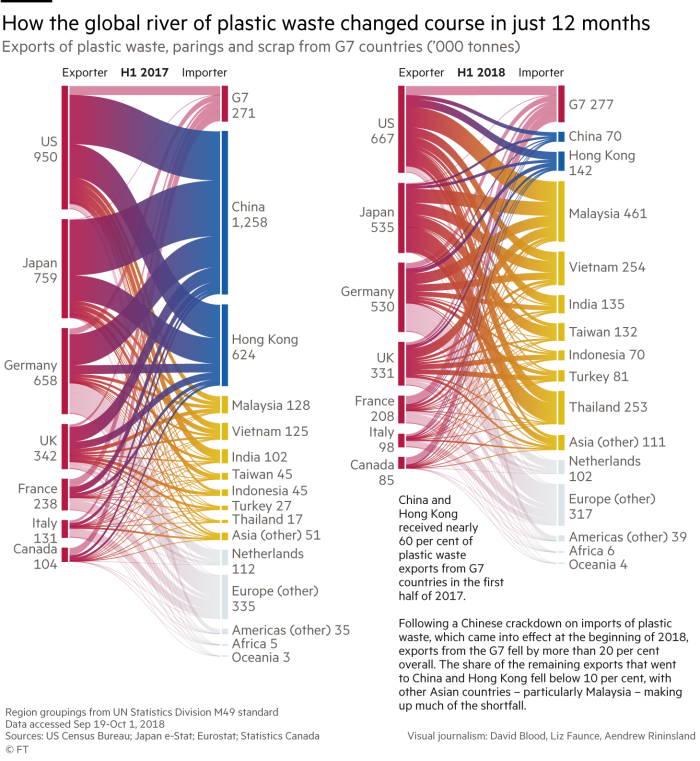

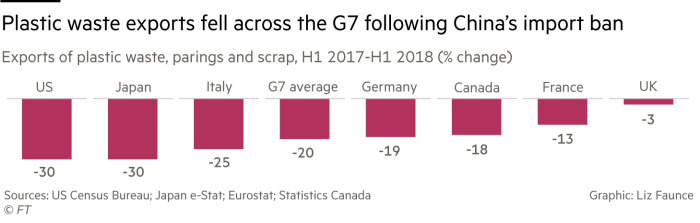

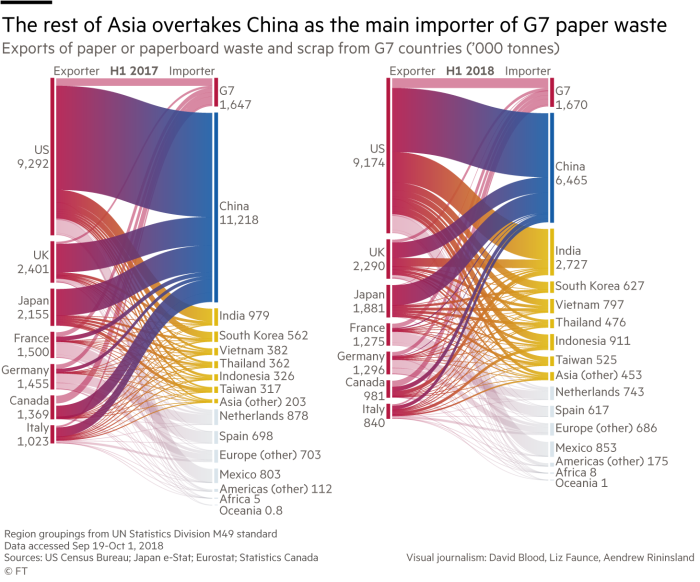

The new policy, called the “National Sword”, was so drastic that when it was first announced many people in the industry did not believe it would actually be implemented. China and Hong Kong went from buying 60 per cent of the plastic waste exported by G7 countries during the first half of 2017, to taking less than 10 per cent during the same period a year later. “It really changed the world, in a way,” says Reed. “China was the world’s biggest customer for paper and plastic.”

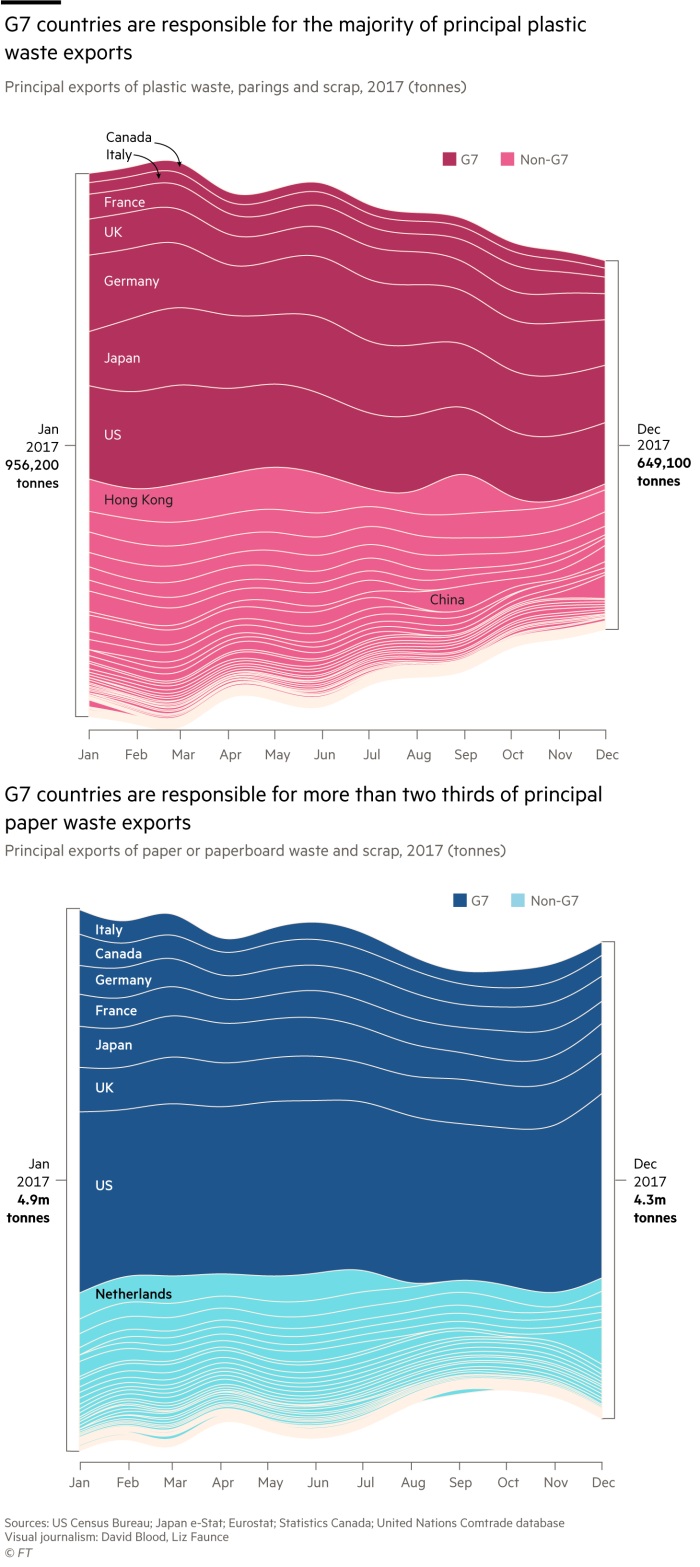

Using publicly available trade data, the FT has traced the exports of plastic and paper scrap from G7 countries, revealing a dramatic increase in the flows of waste into south-east Asia following the China ban. More than three dozen industry executives, policy makers, scrap traders and environmental advocates across the US, Europe and Asia were interviewed for this piece.

The investigation found an industry undergoing unprecedented disruption, with the very purpose of recycling thrown into question. While it has grown and often profited as consumers have become more aware of the environmental costs of landfill, the sector has long had an unsavoury side. This has been exposed by the National Sword policy, as an industry plagued by allegations of smuggling, corruption and pollution has suddenly been thrust into the spotlight.

China’s ban has also laid bare the uncomfortable economics behind household recycling, and triggered a profound re-examination of the practice — one that many say was long overdue.

Using publicly available trade data, the FT has traced the exports of plastic and paper scrap from G7 countries, revealing a dramatic increase in the flows of waste into south-east Asia following the China ban. More than three dozen industry executives, policy makers, scrap traders and environmental advocates across the US, Europe and Asia were interviewed for this piece.

The investigation found an industry undergoing unprecedented disruption, with the very purpose of recycling thrown into question. While it has grown and often profited as consumers have become more aware of the environmental costs of landfill, the sector has long had an unsavoury side. This has been exposed by the National Sword policy, as an industry plagued by allegations of smuggling, corruption and pollution has suddenly been thrust into the spotlight.

China’s ban has also laid bare the uncomfortable economics behind household recycling, and triggered a profound re-examination of the practice — one that many say was long overdue.

Bottles at the PT Elastic Reka Aktif plastic factory in South Cikarang, West Java © Kadir van Lohuizen/NOOR

This is a “moment of truth” for the recycling industry, says Don Slager, chief executive of Republic Services, the second-largest waste-management company in the US. He estimates his group alone will lose out on $150m revenue this year due to China’s National Sword policy.

Eric Kawabata, general manager for Asia-Pacific with TerraCycle, a US-based recycling company, says the China ban has created a “global crisis in plastic waste”. Japan, where he is based, was a big exporter to China before the ban. “Now all this trash is building up in Japan and there’s nothing to do with it; the incinerators are working at full capacity,” he says.

Technically, China does still accept some forms of scrap, but it has set such a high bar for the cleanliness of the materials that can be imported that most people in the industry refer to it as a “ban”.

This is a “moment of truth” for the recycling industry, says Don Slager, chief executive of Republic Services, the second-largest waste-management company in the US. He estimates his group alone will lose out on $150m revenue this year due to China’s National Sword policy.

Eric Kawabata, general manager for Asia-Pacific with TerraCycle, a US-based recycling company, says the China ban has created a “global crisis in plastic waste”. Japan, where he is based, was a big exporter to China before the ban. “Now all this trash is building up in Japan and there’s nothing to do with it; the incinerators are working at full capacity,” he says.

Technically, China does still accept some forms of scrap, but it has set such a high bar for the cleanliness of the materials that can be imported that most people in the industry refer to it as a “ban”.

In the US, many companies have had to send recycling to landfill because there is nowhere else to put it, a painful reversal after decades of growth in recycling programmes. The US exported 30 per cent less plastic scrap in the first half of 2018 compared with a year prior, according to FT data, with much of the material ending up in landfill instead.

“Recycling is like a religion here,” says Laura Leebrick, head of government affairs at Rogue Disposal & Recycling in Southern Oregon. “It has been meaningful for people in Oregon to recycle, they feel like they are doing something good for the planet – and now they are having the rug pulled out from under them.”

After the China ban, Rogue Disposal & Recycling started to limit the types of materials it accepts from households: no more plastics (except for milk jugs), no more glass and no more mixed paper (such as junk mail and cereal boxes). With China out of the market, the cost of managing the recycling programme has tripled, Leebrick says.

“Recycling is like a religion here,” says Laura Leebrick, head of government affairs at Rogue Disposal & Recycling in Southern Oregon. “It has been meaningful for people in Oregon to recycle, they feel like they are doing something good for the planet – and now they are having the rug pulled out from under them.”

After the China ban, Rogue Disposal & Recycling started to limit the types of materials it accepts from households: no more plastics (except for milk jugs), no more glass and no more mixed paper (such as junk mail and cereal boxes). With China out of the market, the cost of managing the recycling programme has tripled, Leebrick says.

Waste being processed at HKS, Amsterdam © Kadir van Lohuizen/NOOR

Globally, about half the plastic intended for recycling is traded overseas, according to a recent study in Science Advances. That percentage is even higher on the US West Coast – California exports two-thirds of the stuff tossed into household recycling bins. Many cities that previously received revenue from their recycling programmes now have to pay hauliers to dispose of the material instead. At the beginning of 2017, a bale of low-grade mixed plastics could fetch $20 per tonne in California, but a year later it cost $10 to dispose of it.

The National Sword policy “challenges us to admit that recycling isn’t free”, says Zoe Heller, assistant policy director at the California state recycling agency, CalRecycle. “What this is really bringing up for California, the US and the rest of the world is that there has to be a paradigm shift in how we think about recycling globally.”

No one knows this better than Steve Wong, who was once the plastic scrap king of China. His empire accounted for about 7 per cent of China’s total plastic scrap imports, with assets that he estimates were worth around $900m. But today he is facing debts instead, after liquidating factories and other properties. The circles under his eyes suggest it has not been an easy few years. Based in Los Angeles, the Hong Kong-raised, British citizen is always on the road. “Life has become difficult,” he says. “I heard about the Chinese ban . . . but I didn’t expect things would turn out to be very harsh, very difficult for recyclers.”

Wong’s career has tracked China’s emergence as the world’s recycling hub. As the country became a global manufacturing powerhouse in the 1990s and 2000s, its factories created a vast source of demand for raw materials. This presented a ready market for the products that come out at the end of the recycling process – for example, the plastic pellets made from recycled material that can be turned into the soles of shoes or thousands of other everyday items.

Globally, about half the plastic intended for recycling is traded overseas, according to a recent study in Science Advances. That percentage is even higher on the US West Coast – California exports two-thirds of the stuff tossed into household recycling bins. Many cities that previously received revenue from their recycling programmes now have to pay hauliers to dispose of the material instead. At the beginning of 2017, a bale of low-grade mixed plastics could fetch $20 per tonne in California, but a year later it cost $10 to dispose of it.

The National Sword policy “challenges us to admit that recycling isn’t free”, says Zoe Heller, assistant policy director at the California state recycling agency, CalRecycle. “What this is really bringing up for California, the US and the rest of the world is that there has to be a paradigm shift in how we think about recycling globally.”

No one knows this better than Steve Wong, who was once the plastic scrap king of China. His empire accounted for about 7 per cent of China’s total plastic scrap imports, with assets that he estimates were worth around $900m. But today he is facing debts instead, after liquidating factories and other properties. The circles under his eyes suggest it has not been an easy few years. Based in Los Angeles, the Hong Kong-raised, British citizen is always on the road. “Life has become difficult,” he says. “I heard about the Chinese ban . . . but I didn’t expect things would turn out to be very harsh, very difficult for recyclers.”

Wong’s career has tracked China’s emergence as the world’s recycling hub. As the country became a global manufacturing powerhouse in the 1990s and 2000s, its factories created a vast source of demand for raw materials. This presented a ready market for the products that come out at the end of the recycling process – for example, the plastic pellets made from recycled material that can be turned into the soles of shoes or thousands of other everyday items.

Plastic bottles being recycled at the Minato Resource Centre, Tokyo © Kadir van Lohuizen/NOOR

The increasing demand coincided with the growth of recycling in the western world. A quirk of the global trade system also helped: the ships that set out full of “Made in China” goods often returned home with very little in them. Here was an opportunity to fill their containers with recycling scrap.

China’s earliest recycling companies made fortunes taking advantage of this. The country’s first female billionaire, Zhang Yin, built her company, Nine Dragons, by importing paper from the US and operating mills at home. China’s combination of ready demand, cheap labour and lax environmental regulation made it ideal as the world’s recycling hub.

Together with Hong Kong, it imported $81bn worth of plastic scrap between 1988 and 2016, according to the study in Science Advances. However, the mood shifted several years ago, as China got serious about cleaning up its environment. The recycling industry fell out of favour, due in part to corruption and poor environmental practices, but also because Chinese officials didn’t want the country to be seen as the world’s dumping ground.

“If things are imported, they call it yang laji – foreign trash – but their own [waste], even if it is not such good quality, they call [it] resources,” Wong points out. China also wanted to get a handle on its own waste-management systems. Poorly run recycling plants that dumped wastewater and contaminated the environment kept popping up, despite the government’s repeated efforts to clean up the sector.

“China finally realised that it was a net deficit to their country to take this scrap,” says Jim Puckett, director of the Basel Action Network, a non-profit focused on the hazardous waste trade. “The harm to the groundwater and the harm to the air, those have big economic costs.”

In 2013, China introduced a policy called “Green Fence”, which tightened existing regulations on recycling, and Wong says that was when his company started losing money. When National Sword arrived, things became even worse. “I know people who have gone bankrupt,” he says. Some Chinese scrap traders have even ended up in jail as part of the country’s efforts to clean up the industry. “I’ve been told I shouldn’t go back.”

Wong still has a hand in the trade and usually wakes up before dawn to work the phones. On the morning we meet, he has already bought two containers of gasoline tanks salvaged from old cars, and 60 containers of plastic covering that had been used on vineyards. “Every day I make some deals,” he says, even if they may be much smaller than what he was used to. He has become cynical about the sector, however. “The ones who are left are poor, or they are scammers,” he says.

With China’s door closed since the beginning of the year, much of the plastic scrap has flowed to south-east Asia instead – where it has triggered a new type of environmental crisis. Out of China’s 1,700 licensed importers, at least a third have relocated to south-east Asia, Wong estimates. The region has been inundated with plastic scrap in far greater quantities than it can handle.

In the span of just a few months, Malaysia has become the biggest importer of plastic scrap in the world, with a volume that is now twice that of China and Hong Kong. Between the first half of 2017 and the first half of 2018, Vietnam saw its imports of plastic scrap double, while shipments to Indonesia rose 56 per cent, according to data compiled by the FT. The country that has seen the biggest percentage increase of all is Thailand, where imports surged 1,370 per cent.

At the port of Laem Chabang on Thailand’s eastern seaboard, the sun beats down on a busy six-lane highway and a railway freight line. This is the kingdom’s busiest port, and a principal gateway for free trade with the outside world – a showcase for Thailand’s export-driven economy.

But this year the port has gained notoriety among Thai environmentalists for another reason: as the main entry point for record imports of plastic, electronic waste and the world’s other rubbish. In May, police swooped on terminal C3, where they searched seven containers and found electronic waste – hazardous if not disposed of safely – falsely declared on customs forms as plastic.

As imports have risen, they have been met with a growing backlash, and south-east Asian governments have been trying to curb the amounts of waste they take in. In Thailand, the crackdown has included a series of such raids on scrap-processing facilities, dump sites and ports.

The increasing demand coincided with the growth of recycling in the western world. A quirk of the global trade system also helped: the ships that set out full of “Made in China” goods often returned home with very little in them. Here was an opportunity to fill their containers with recycling scrap.

China’s earliest recycling companies made fortunes taking advantage of this. The country’s first female billionaire, Zhang Yin, built her company, Nine Dragons, by importing paper from the US and operating mills at home. China’s combination of ready demand, cheap labour and lax environmental regulation made it ideal as the world’s recycling hub.

Together with Hong Kong, it imported $81bn worth of plastic scrap between 1988 and 2016, according to the study in Science Advances. However, the mood shifted several years ago, as China got serious about cleaning up its environment. The recycling industry fell out of favour, due in part to corruption and poor environmental practices, but also because Chinese officials didn’t want the country to be seen as the world’s dumping ground.

“If things are imported, they call it yang laji – foreign trash – but their own [waste], even if it is not such good quality, they call [it] resources,” Wong points out. China also wanted to get a handle on its own waste-management systems. Poorly run recycling plants that dumped wastewater and contaminated the environment kept popping up, despite the government’s repeated efforts to clean up the sector.

“China finally realised that it was a net deficit to their country to take this scrap,” says Jim Puckett, director of the Basel Action Network, a non-profit focused on the hazardous waste trade. “The harm to the groundwater and the harm to the air, those have big economic costs.”

In 2013, China introduced a policy called “Green Fence”, which tightened existing regulations on recycling, and Wong says that was when his company started losing money. When National Sword arrived, things became even worse. “I know people who have gone bankrupt,” he says. Some Chinese scrap traders have even ended up in jail as part of the country’s efforts to clean up the industry. “I’ve been told I shouldn’t go back.”

Wong still has a hand in the trade and usually wakes up before dawn to work the phones. On the morning we meet, he has already bought two containers of gasoline tanks salvaged from old cars, and 60 containers of plastic covering that had been used on vineyards. “Every day I make some deals,” he says, even if they may be much smaller than what he was used to. He has become cynical about the sector, however. “The ones who are left are poor, or they are scammers,” he says.

With China’s door closed since the beginning of the year, much of the plastic scrap has flowed to south-east Asia instead – where it has triggered a new type of environmental crisis. Out of China’s 1,700 licensed importers, at least a third have relocated to south-east Asia, Wong estimates. The region has been inundated with plastic scrap in far greater quantities than it can handle.

In the span of just a few months, Malaysia has become the biggest importer of plastic scrap in the world, with a volume that is now twice that of China and Hong Kong. Between the first half of 2017 and the first half of 2018, Vietnam saw its imports of plastic scrap double, while shipments to Indonesia rose 56 per cent, according to data compiled by the FT. The country that has seen the biggest percentage increase of all is Thailand, where imports surged 1,370 per cent.

At the port of Laem Chabang on Thailand’s eastern seaboard, the sun beats down on a busy six-lane highway and a railway freight line. This is the kingdom’s busiest port, and a principal gateway for free trade with the outside world – a showcase for Thailand’s export-driven economy.

But this year the port has gained notoriety among Thai environmentalists for another reason: as the main entry point for record imports of plastic, electronic waste and the world’s other rubbish. In May, police swooped on terminal C3, where they searched seven containers and found electronic waste – hazardous if not disposed of safely – falsely declared on customs forms as plastic.

As imports have risen, they have been met with a growing backlash, and south-east Asian governments have been trying to curb the amounts of waste they take in. In Thailand, the crackdown has included a series of such raids on scrap-processing facilities, dump sites and ports.

Washing plastic bags at Bantar Gebang, Indonesia © Kadir van Lohuizen/NOOR

The Department of Industrial Works, which oversees waste management, told the FT that plastic imports would be banned within two years. Most of the plastic has been entering the country in violation of rules set by the ministry, says Banjong Sukreeta, a deputy director. “We found that importers were importing plastic scrap not only for use in their own factories, but [they] resold it and sent it to other factories to process,” he says. “That’s against the rules.”

As the police raid at Laem Chabang revealed, some importers were falsifying customs declarations, marking containers as holding plastic scraps as a front for smuggling electronic waste. “On our inspections of plastic, 95 per cent violated rules and didn’t pass inspection,” Banjong says.

Meanwhile, hundreds of scrap-processing facilities have sprung up near the port, often triggering complaints from locals about the pollution they produce. One woman keeping tabs on these plants – not all of which are fully legal – is Penchom Saetang, the head of Ecological Alert and Recovery Thailand, a non-profit group. She counts more than 1,300 companies involved in recycling, landfills or processing electronic waste in the eight provinces around the port.

“When we talk about recycling, the concept is good and the objectives are good,” she says. “But if the recycling industry is good, why do America, Europe, Korea and Japan have to export to other countries? Can you answer me that?”

It’s a question more and more people are asking, as governments across the region try to figure out how to respond. After bales of plastic piled up at ports in Vietnam this spring, the country declared it would not “become the landfill of the world” and stopped issuing licences for imports of paper, plastic, metal and other waste.

Malaysia has also been fighting a string of illegal recycling factories that have emerged to process the plastic that China didn’t want. Earlier this month, minister Yeo Bee Yin said the government was freezing imports of plastic waste. A recent investigation by Greenpeace Unearthed discovered British recycling in Malaysian dumps – including recycling sacks from local councils Hammersmith and Fulham and the Royal Borough of Kensington and Chelsea.

The Department of Industrial Works, which oversees waste management, told the FT that plastic imports would be banned within two years. Most of the plastic has been entering the country in violation of rules set by the ministry, says Banjong Sukreeta, a deputy director. “We found that importers were importing plastic scrap not only for use in their own factories, but [they] resold it and sent it to other factories to process,” he says. “That’s against the rules.”

As the police raid at Laem Chabang revealed, some importers were falsifying customs declarations, marking containers as holding plastic scraps as a front for smuggling electronic waste. “On our inspections of plastic, 95 per cent violated rules and didn’t pass inspection,” Banjong says.

Meanwhile, hundreds of scrap-processing facilities have sprung up near the port, often triggering complaints from locals about the pollution they produce. One woman keeping tabs on these plants – not all of which are fully legal – is Penchom Saetang, the head of Ecological Alert and Recovery Thailand, a non-profit group. She counts more than 1,300 companies involved in recycling, landfills or processing electronic waste in the eight provinces around the port.

“When we talk about recycling, the concept is good and the objectives are good,” she says. “But if the recycling industry is good, why do America, Europe, Korea and Japan have to export to other countries? Can you answer me that?”

It’s a question more and more people are asking, as governments across the region try to figure out how to respond. After bales of plastic piled up at ports in Vietnam this spring, the country declared it would not “become the landfill of the world” and stopped issuing licences for imports of paper, plastic, metal and other waste.

Malaysia has also been fighting a string of illegal recycling factories that have emerged to process the plastic that China didn’t want. Earlier this month, minister Yeo Bee Yin said the government was freezing imports of plastic waste. A recent investigation by Greenpeace Unearthed discovered British recycling in Malaysian dumps – including recycling sacks from local councils Hammersmith and Fulham and the Royal Borough of Kensington and Chelsea.

Many of the new factories that have sprung up to take the scrap embody some of the trade’s worst characteristics. “We call them ‘the cowboys’ in the industry,” says Max Craipeau, a French plastics trader in Hong Kong. “They do business in a very bad manner. These guys are now typically bankrupt in south-east Asia because the government shut down their operations.”

A “cowboy” operation usually dispenses with any environmental controls, he explains, such as wastewater treatment facilities. The plastic recycling process involves washing the materials, producing wastewater full of contaminants, and heating up the plastic to produce pellets, which can release chemical additives and emissions into the air.

In Thailand, such shady recycling facilities have become the target of national outrage. Earlier this year, police raids were broadcast live on television, stirring a national debate about plastics and the surge in electronic waste – old computer parts, keyboards and phones.

Amid cassava fields in the village of Thathan, on Thailand’s eastern seaboard, blue tarpaulins barely conceal heaps of electronic waste exposed to the open air. Local residents say trucks full of e-waste began arriving shortly after New Year – 10 or 20 a night. By April, the factory’s Chinese and Thai owners, He Jia Enterprise, had begun burning plastic e-waste to extract copper from it, blanketing the fields with noxious smoke that made some villagers feel faint.

“It’s one of those smells that stays inside your nose and makes it feel sore,” says Panpuch Srithat, a local resident who runs a small business. A double-length truck bearing wire trundles through the village as she speaks. “They bring stuff nobody wants into our country,” she continues. “They only gain and gain. And who loses? Our country loses.”

Electronic waste is far more toxic to process than most household plastic, because it contains a range of harmful substances, including heavy metals such as lead. But the factors that allow e-waste to find its way into the countries that are least able to deal with it safely are the same as those that have allowed the tide of unwanted plastic to sweep across south-east Asia this year.

Rough waste at the Van Gansewinkel plant, Amsterdam © Kadir van Lohuizen/NOOR

Environmental advocates such as Puckett, the head of the Basel Action Network, see it as evidence of a failure in the global trade system. “This takes place because of free trade rules where you can stick things on a boat and take them to a place where those controls are not as high,” he says.

As for the He Jia factory managers, they say they have done nothing wrong. The factory changed ownership in April, after the outcry. General manager Winaaithorn Rakkbuathong tells the FT the plant is following all environmental regulations and trade laws.

He denies the factory has been dumping wastewater into the ground – an accusation raised by villagers – and says all workers wear protective gear, including glasses, masks and gloves. “Have you ever heard of the Basel treaty?” he says, with an obliging smile and a nod of the head. “The Basel Convention says you can export and import waste for disposal.”

It’s one of those smells that stays inside your nose and makes it feel sore . . . they bring stuff nobody wants into our country. They only gain and gain. And who loses? Our country losesPanpuch Srithat, businesswoman, Thathan, Thailand

In fact, the text of the Basel Convention is not exactly what Winaaithorn describes. The treaty, which was created in 1989 to regulate the trade in hazardous waste, says e-waste can only be exported to developing countries with their consent. However, it does not regulate trade in plastics, and there is a growing debate within Thailand and around the world about whether these measures are enough.

“People have been shipping goods left and right, without checking whether they can recycle that quantity or not,” says Surendra Borad Patawari, chief executive of Gemini Corporation, a plastics and steel trading company in Belgium. “We should be obliged to check: do they [the importers] have recycling facilities?”

More regulation may be on the way: earlier this year, Norway introduced a proposal that would add some types of plastic waste to the list of the materials regulated under the convention. If approved, shipments of certain plastic wastes would require prior approval from the recipient countries.

Ola Elvestuen, the Norwegian environment minister, told the FT that the Basel Convention should be used to “get better control of the flow of problematic waste” around the world. “Massive amounts of them [plastic waste] are being traded, and a lot of them are mixed – it is contaminated, it is waste that is difficult or impossible to recycle, and that we need to get better control of,” he says.

Norway’s proposal has already gathered support from more than 20 countries, although the EU opposes the move, as do many scrap traders. Adina Adler, head of international relations at the Institute of Scrap Recycling Industries in Washington DC, argues that the policy would stifle trade. “Scrap is not rubbish, it is not trash, it is a valuable input,” she says. “If Norway’s proposal is approved, it could set a precedent for more [restrictions] . . . A lot of the developing world does not have recycling capabilities. So to the extent that they can collect it, they will ship it to another country.”

Some worry that a trash trade war may be brewing, as more and more countries shut their doors to scrap. “We are living in a time of nationalism, and these bans are also a part of that,” says Tom Szaky, chief executive of TerraCycle, referring to the steps taken in south-east Asia.

The ripple effects of China closing its borders to our trash are only now becoming apparent. One consequence is a wave of new investment in scrap-processing facilities in the developed world. Now that China no longer wants to be the destination for the world’s recycling, the burden is shifting back to more developed countries such as the US, EU and Japan.

“In the long term it will prove positive, because we will have to focus more on our own recycling capacity,” says Karmenu Vella, European commissioner for the environment. He estimates that an additional 250 sorting facilities and 300 recycling plants will be needed by 2025. For companies that make the necessary machines, sales are booming and order books have developed a backlog.

The same thing is happening in the US – and many of the investors there are Chinese. Unable to meet their demand for paper pulp or plastic pellets at home, China’s biggest recycling companies are purchasing mills or plants in America.

Nine Dragons, China’s biggest maker of paper and cardboard, recently announced it is buying two paper mills in the US, and plans to invest $300m in the facilities. Other Chinese recycling companies have invested in recycling plants in Georgia, South Carolina, Alabama and Kentucky.

Environmental advocates such as Puckett, the head of the Basel Action Network, see it as evidence of a failure in the global trade system. “This takes place because of free trade rules where you can stick things on a boat and take them to a place where those controls are not as high,” he says.

As for the He Jia factory managers, they say they have done nothing wrong. The factory changed ownership in April, after the outcry. General manager Winaaithorn Rakkbuathong tells the FT the plant is following all environmental regulations and trade laws.

He denies the factory has been dumping wastewater into the ground – an accusation raised by villagers – and says all workers wear protective gear, including glasses, masks and gloves. “Have you ever heard of the Basel treaty?” he says, with an obliging smile and a nod of the head. “The Basel Convention says you can export and import waste for disposal.”

It’s one of those smells that stays inside your nose and makes it feel sore . . . they bring stuff nobody wants into our country. They only gain and gain. And who loses? Our country losesPanpuch Srithat, businesswoman, Thathan, Thailand

In fact, the text of the Basel Convention is not exactly what Winaaithorn describes. The treaty, which was created in 1989 to regulate the trade in hazardous waste, says e-waste can only be exported to developing countries with their consent. However, it does not regulate trade in plastics, and there is a growing debate within Thailand and around the world about whether these measures are enough.

“People have been shipping goods left and right, without checking whether they can recycle that quantity or not,” says Surendra Borad Patawari, chief executive of Gemini Corporation, a plastics and steel trading company in Belgium. “We should be obliged to check: do they [the importers] have recycling facilities?”

More regulation may be on the way: earlier this year, Norway introduced a proposal that would add some types of plastic waste to the list of the materials regulated under the convention. If approved, shipments of certain plastic wastes would require prior approval from the recipient countries.

Ola Elvestuen, the Norwegian environment minister, told the FT that the Basel Convention should be used to “get better control of the flow of problematic waste” around the world. “Massive amounts of them [plastic waste] are being traded, and a lot of them are mixed – it is contaminated, it is waste that is difficult or impossible to recycle, and that we need to get better control of,” he says.

Norway’s proposal has already gathered support from more than 20 countries, although the EU opposes the move, as do many scrap traders. Adina Adler, head of international relations at the Institute of Scrap Recycling Industries in Washington DC, argues that the policy would stifle trade. “Scrap is not rubbish, it is not trash, it is a valuable input,” she says. “If Norway’s proposal is approved, it could set a precedent for more [restrictions] . . . A lot of the developing world does not have recycling capabilities. So to the extent that they can collect it, they will ship it to another country.”

Some worry that a trash trade war may be brewing, as more and more countries shut their doors to scrap. “We are living in a time of nationalism, and these bans are also a part of that,” says Tom Szaky, chief executive of TerraCycle, referring to the steps taken in south-east Asia.

The ripple effects of China closing its borders to our trash are only now becoming apparent. One consequence is a wave of new investment in scrap-processing facilities in the developed world. Now that China no longer wants to be the destination for the world’s recycling, the burden is shifting back to more developed countries such as the US, EU and Japan.

“In the long term it will prove positive, because we will have to focus more on our own recycling capacity,” says Karmenu Vella, European commissioner for the environment. He estimates that an additional 250 sorting facilities and 300 recycling plants will be needed by 2025. For companies that make the necessary machines, sales are booming and order books have developed a backlog.

The same thing is happening in the US – and many of the investors there are Chinese. Unable to meet their demand for paper pulp or plastic pellets at home, China’s biggest recycling companies are purchasing mills or plants in America.

Nine Dragons, China’s biggest maker of paper and cardboard, recently announced it is buying two paper mills in the US, and plans to invest $300m in the facilities. Other Chinese recycling companies have invested in recycling plants in Georgia, South Carolina, Alabama and Kentucky.

China’s new rules are also forcing American scrap traders and producers to do more of the dirty work themselves, to meet the very high standards that China will still accept. George Adams, chief executive of SA Recycling, one of the biggest scrap metal traders in the US, says he recently installed a new line to wash aluminium waste before it is sent to China. “You can eat off my aluminium, it is that clean,” he says. Similar changes are taking place elsewhere: the Recology facility in San Francisco recently spent $3m installing a new optical sensor that will reduce the impurities in its bales.

As for the traders, while many have gone bankrupt or left the industry, a few have capitalised on the change. One of these is Craipeau, the Hong Kong-based trader, who has shifted his focus to selling plastic pellets – which are not covered by the waste ban – back into China.

People have been shipping goods left and right, without checking whether or not the importers can recycle that quantitySurendra Borad Patawari, Gemini Corporation, Belgium

“Overnight, China has transformed itself from being the world’s largest processor of plastic scrap to being the world’s largest importer of plastic pellets,” he explains. Demand for plastic pellets is higher than ever because manufacturers still need them. Craipeau currently works with a recycling plant in Indonesia, and is planning to open new ones in Poland and the US.

Meanwhile, many household recycling programmes have found ways to continue, although sometimes in a different form. “This China thing is causing me a bit of heartburn in 2018,” says Slager, the chief executive of Republic Services. “But on another level I am frankly elated, because it is giving us a reason to wake up and fix this part of the business.” One priority is cleaning up the recycling stream to stop people putting dirty trash in their recycling bins, he says.

The Question: a solutions-based conversation between FT readers and journalists

Do you have any questions for Leslie Hook or ideas for improving the world's broken recycling system? Drop them in the comments below. Leslie will be responding to your thoughts and questions throughout the day.

The world has produced more than 6.3 billion tonnes of plastic waste since the 1950s – making plastic one of the largest man-made materials on the planet, behind steel and cement. Of that volume, more than half was produced in the last 16 years, amid a global boom in single-use, disposable plastic, according to an academic paper, Production, Use and Fate of All Plastics Ever Made.

Roland Geyer, the author of the study, says the National Sword policy was a wake-up call. “I think that plastic recycling hasn’t really worked before the China ban,” he says. Even before the ban, only 10 per cent of the plastic in the US was being recycled. “Just making a bit more effort with the recycling is not going to cut it.”

For decades, policy makers have focused on increasing the collection of recyclables and raising the “diversion rate” – the percentage of household waste that gets diverted from landfills or incinerators. But more people are saying that has been focusing on the wrong thing.

Household electronics for recycling at waste company AEB, Amsterdam © Kadir van Lohuizen/NOOR

“We have not been successful at recycling. After 40 years of trying, we have not been able to make it work,” points out Ellen MacArthur, the yachtswoman who went on to launch an environmental group, the Ellen MacArthur Foundation, which has worked on reducing plastic waste. “It needs a systemic change,” she says. The root problem is the pattern of linear consumption that the world’s consumers have become accustomed to: taking resources from the natural world, using them, disposing of them.

She believes the solution is the “circular economy”, which reuses resources rather than consuming them. Her eyes light up as she describes what this would look like. The single-use plastic packaging that lines supermarket aisles today could be reimagined: a fifth of packaging could be reusable, like a bottle that is refilled. And half of the packaging could be redesigned with recycling in mind.

Better packaging design will help, but others advocate even more extreme measures. Back at the Recology facility in San Francisco, Reed admits at the end of our tour that 20 years in the industry has made him a “zero waste” advocate. “I never buy any of this stuff,” he says, gesturing to a bale of clear plastic sandwich containers. Instead, he shops in bulk, bringing his own bottles and sacks to special stores that sell food and household products by weight.

It’s a lifestyle that has long had advocates in California and has recently gained traction in Europe, with the number of bulk stores in France and Italy surging over the past year. “One of the most important lessons we’ve learnt from zero waste is that a lot of the solutions are in the past,” Reed says. “Just ask yourself, what was it like when your grandparents were alive? They didn’t have single-use coffee cups, didn’t have water bottles. And yet they survived – thrived, in fact.”

How recycling happens

What happens to the milk carton you throw in your recycling bin? Details vary by region and government but often the path is broadly similar: once collected, household recycling is sorted into bales, which are then sold on to be processed into material. A bale of cardboard will go to a special mill, where it is cleaned and broken down to paper pulp, which will be used to make new paper products.

The collection company sorts the items and sells some materials — the ones that have value — on to brokers, or to plants that will do another round of sorting and cleaning. The material will be sold on for further processing until it eventually reaches the end customer: a manufacturer that needs the material as a feedstock for its products. Plastics are one of the hardest materials to recycle. There are dozens of types of plastics in everyday use, which must be separated before recycling. After sortation, the bales are sent to a recycling facility to be further washed and cleaned.

This is where the process gets much trickier. Take a plastic water bottle, which is typically made of PET, one of the more valuable types of plastic. When the bottles arrive at the factory, they are washed and dunked in chemicals to get the labels off, then chopped into bits. A flotation pool is used to separate the lid plastic from the bottle plastic. Three different materials come out at the end: lid flakes, bottle flake and labels.

The final step is to “extrude” the flakes, or melt them down into pellets. This requires energy to heat the flakes, and can emit harmful chemicals into the air, due to additives in the plastic. The pellets are then sold on to manufacturers who use them as a feedstock.

It is possible to do all of this in an environmentally friendly way: treating the wastewater correctly, disposing of chemicals properly and making sure harmful emissions don’t escape. Done right, this uses less energy and resources than virgin material. But if shortcuts are taken, the consequences can be devastating.

Leslie Hook is the FT’s environment correspondent; John Reed is the FT’s south-east Asia correspondent

Data investigation by David Blood

Additional reporting by Ryn Jirenuwat

Why the world’s recycling system stopped working | Financial Times

.

.

.

“We have not been successful at recycling. After 40 years of trying, we have not been able to make it work,” points out Ellen MacArthur, the yachtswoman who went on to launch an environmental group, the Ellen MacArthur Foundation, which has worked on reducing plastic waste. “It needs a systemic change,” she says. The root problem is the pattern of linear consumption that the world’s consumers have become accustomed to: taking resources from the natural world, using them, disposing of them.

She believes the solution is the “circular economy”, which reuses resources rather than consuming them. Her eyes light up as she describes what this would look like. The single-use plastic packaging that lines supermarket aisles today could be reimagined: a fifth of packaging could be reusable, like a bottle that is refilled. And half of the packaging could be redesigned with recycling in mind.

Better packaging design will help, but others advocate even more extreme measures. Back at the Recology facility in San Francisco, Reed admits at the end of our tour that 20 years in the industry has made him a “zero waste” advocate. “I never buy any of this stuff,” he says, gesturing to a bale of clear plastic sandwich containers. Instead, he shops in bulk, bringing his own bottles and sacks to special stores that sell food and household products by weight.

It’s a lifestyle that has long had advocates in California and has recently gained traction in Europe, with the number of bulk stores in France and Italy surging over the past year. “One of the most important lessons we’ve learnt from zero waste is that a lot of the solutions are in the past,” Reed says. “Just ask yourself, what was it like when your grandparents were alive? They didn’t have single-use coffee cups, didn’t have water bottles. And yet they survived – thrived, in fact.”

How recycling happens

What happens to the milk carton you throw in your recycling bin? Details vary by region and government but often the path is broadly similar: once collected, household recycling is sorted into bales, which are then sold on to be processed into material. A bale of cardboard will go to a special mill, where it is cleaned and broken down to paper pulp, which will be used to make new paper products.

The collection company sorts the items and sells some materials — the ones that have value — on to brokers, or to plants that will do another round of sorting and cleaning. The material will be sold on for further processing until it eventually reaches the end customer: a manufacturer that needs the material as a feedstock for its products. Plastics are one of the hardest materials to recycle. There are dozens of types of plastics in everyday use, which must be separated before recycling. After sortation, the bales are sent to a recycling facility to be further washed and cleaned.

This is where the process gets much trickier. Take a plastic water bottle, which is typically made of PET, one of the more valuable types of plastic. When the bottles arrive at the factory, they are washed and dunked in chemicals to get the labels off, then chopped into bits. A flotation pool is used to separate the lid plastic from the bottle plastic. Three different materials come out at the end: lid flakes, bottle flake and labels.

The final step is to “extrude” the flakes, or melt them down into pellets. This requires energy to heat the flakes, and can emit harmful chemicals into the air, due to additives in the plastic. The pellets are then sold on to manufacturers who use them as a feedstock.

It is possible to do all of this in an environmentally friendly way: treating the wastewater correctly, disposing of chemicals properly and making sure harmful emissions don’t escape. Done right, this uses less energy and resources than virgin material. But if shortcuts are taken, the consequences can be devastating.

Leslie Hook is the FT’s environment correspondent; John Reed is the FT’s south-east Asia correspondent

Data investigation by David Blood

Additional reporting by Ryn Jirenuwat

Why the world’s recycling system stopped working | Financial Times

.

.

.

No comments:

Post a Comment